NEWS

Meti Corporate Finance acts as the exclusive financial advisor to Groupack Holdings S.A. pertaining to a capital increase subscribed by Three Hills, Azimut Libera Impresa and HAT

BACKGROUND

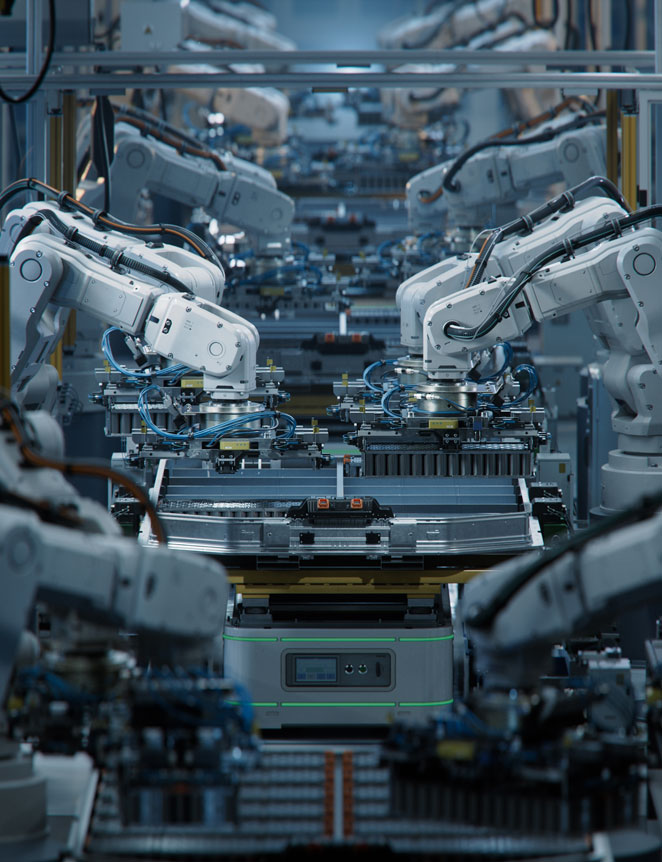

Founded in 2022, Groupack Holdings S.A. is the holding company of Mech-I-Tronic, the buy- and-build platform in the packaging sector promoted by Marco Giovannini, shareholder and former CEO of Guala Closures, and Claudio Giuliano, former executive at Carlyle and Bain Capital, with the aim of becoming a leader in the mechatronic sector

The group currently includes 6 entities: (i) Bettinelli (automation solutions for assembly and testing lines), (ii) Union (extrusion lines for plastic materials), (iii) Alci (automation solutions), (iv) Neyret (automatic assembly lines), (v) Ermo (injection molds), (vi) SMP (injection molds)

The group recorded pro-forma revenues of € 165 million as of December 31st 2024, employs approximately 900 people and operates in 25 countries

PROCESS

Meti Corporate Finance supported Groupack by carrying out the following activities: (i) advisory in the fundraising process, (ii) analysis and structuring of the transaction, (iii) support in drafting the process documents, (iv) assistance during negotiations

OUT COME

The transaction has been finalized in May 2025

The transaction enables Mech-I-Tronic to secure the financial resources needed to pursue the group’s growth objectives through acquisitions, organic development and expansion into new markets, with the goal of reaching € 500 million in revenue by 2028